The general economic cooling-off and a diminishing of consumers’ propensity to spend can endanger the growth of sales in the DIY market just as much as a fall in demand in the housing sector. However, according to investigations by the census authority, over 50 per cent of houses are more than 30 years old, which means they are in need of renovation. Added to this is the fact that today’s generation of house owners is financially well off. In order to boost their sales still further the DIY multiples are expanding their range of products in the decorative segment: female customers are to ensure sales growth with their interior decoration, curtains, flooring, lighting, kitchen and bathroom fittings in addition to housewares. This segment will continue to grow in significance in the future.

This year’s DIY sales are expected to increase by 6.3 per cent to US $ 168.9 bn according to the six-monthly forecast of the Home Improvement Research Institute (HIR) of Tampa, Florida, published in the middle of June. It is assumed that there will be annual growth rates of 4.5 per cent by 2004. For 1999 the Institute ascertained sales growth of 7.3 per cent to US $ 158.9 bn.

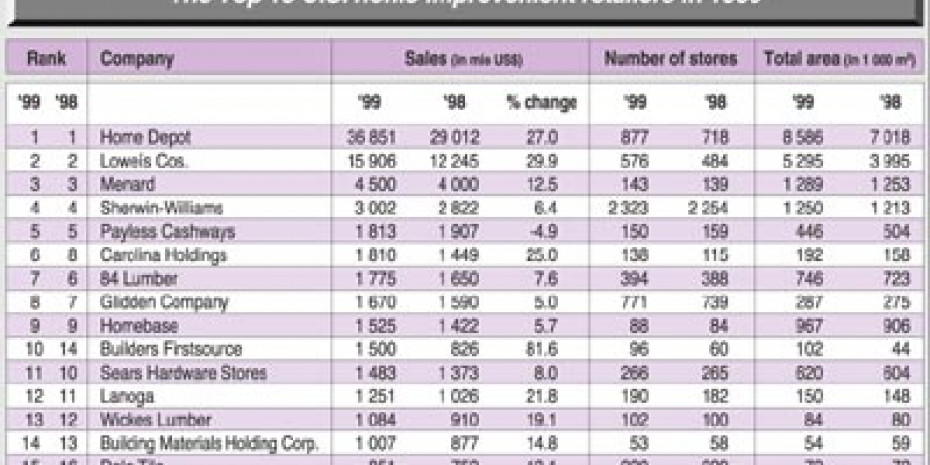

The winners among the 15 major DIY multiples in the USA in 1999 in terms of sales were The Home Depot (27 per cent), Lowe’s (29.9 per cent), Caroline Holdings (25 per cent) and Lanoga (21.8 per cent). Though this sales growth goes hand in hand with expanding floorspace. Builders Firstsource was the most expansionary concern in relation to size within the Top 15, recording 132 per cent growth in floorspace and sales growth of 81 per cent.

Last year’s biggest loser in the US DIY business was Hechinger of Largo, Maryland. In June 1999 this traditional DIY retail concern attempted to salvage its business by means of reorganisation and a new store concept following the closure of 89 loss-making stores. However, continuing losses and tough competition made any reorganisation impossible. The merger that…

Menü

Menü

Newsletter

Newsletter