As can be seen from figures collected by the Unibal manufacturers' association, the winners here were the DIY stores. Their sales increased by 1.3 per cent to € 18.978 bn, lifting their market share from 76.2 to 77 per cent. This figure includes sales by DIY stores of garden products, which amounted to € 2.327 bn (yielding a volume of € 16.651 bn for pure DIY sales). In the DIY sector alone, therefore, a negative has turned into a positive, because sales here, too, were down by one per cent in 2013.

It should be said, however, that a portion of this sales growth was by no means organic: the increase in VAT from 19.6 to 20.0 per cent on 1 January 2014 raised gross prices by 3.2 per cent.

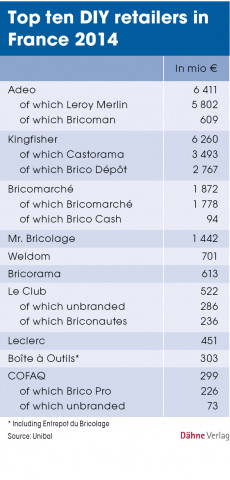

Castorama, belonging to British arch-rival Kingfisher, is in second place with € 3.493. Including sales by Brico Dépôt stores, which bring its overall sales to € 6.260 bn, Kingfisher is a close runner-up to Groupe Adeo in the rankings of Europe's biggest DIY store operators also. The gap between the two in the French market increased in 2014: while Groupe Adeo saw growth of 1.2 per cent, Kingfisher grew by just 0.2 per cent in its biggest single market.

Only two other companies in the French top ten behind the two major players have sales exceeding the billion-euro mark. These are Bricomarché with € 1.872 bn and Mr. Bricolage with € 1.442 bn in sales to French consumers.

Menü

Menü

Newsletter

Newsletter