Home Depot, the number one in the global DIY industry, has concentrated more on diversification since Bob Nardelli took over

Maintenance Supply serves firms and people responsible for building repair and maintenance

At $ 50 billion and about 1 300 stores when Bob Nardelli, coming from General Electric, took over, one wonders if the company could have continued its growth without changes to its oper-ational methods. Under two of the founders, Bernie Marcus and Arthur Blank, it was decentralised, with lots of local autonomy provided to merchants and managers. Its fabulous growth (recently some 200 stores a year) undoubtedly had strained the system. Its success had turned many employees into wealthy stockowners, who might decide to retire at any time.

When Nardelli took over, he obviously decided changes needed to be made quickly and decisively if the company was to continue growing at anything like the pace of previous years. This led to noticeable disruption: a switch from full-timers to part-timers, a departure of many seasoned executives, a change from decentralisation to centralisation in Atlanta, and a precipitous decline in its stock price. Many industry observers felt that too much was tried too quickly.

Home Depot in Glenview is one of the new, smaller format stores of 5 500 to 6 500 m².

Many of the wealthy employees of long standing left, apparently objecting to the curtailing of their long-established freedom of decision-making, and many because they as regional exe- cutives were to be moved to Atlanta as part of Nardelli’s centralisation process.

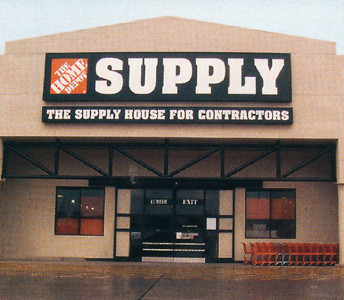

Home Depot Supply is a new format specifically targeting professional business.

The company’s growth has slowed somewhat and its main competitor, Lowes, seems to have captured Wall Street’s imagination. Under Nardelli and his realigned executive team the company is embarking on a diversified expansion programme, instead of relying primarily on its original warehouse concept.

Landscape Supply, with eight units already, targets landscape professionals.

But Nardelli appears to be a realist. He admits some of his ideas did not work and he has changed them. He is making big investments in warehousing technology, employee training programmes and modernising stores by increasing lighting, improving signage and establishing Design Centers to lessen the “warehouse” look.

Morale noticeably poorer

Manufacturers and sales representatives who work with the company say there is a noticeable decline in morale, and that there is a certain degree of fear now evident. Decisions may be questioned by superiors, so sometimes decisions simply are not made. Many buyers also appear to be reluctant to make decisions or refer them to committee group-think. Some of the entrepreneurial enthusiasm and brilliance is now displaced by bureaucracy.

The Home Depot in Lincoln Park, a Chicago neighbourhood, extends over two storeys and features more up-market presentations. A fore-taste of the future?

By centralising buying in Atlanta, Nardelli’s new policies did, indeed, bring greater discipline to the buying process, but also restricted the freedom buyers had to try new products, new display techniques, new promotions. Perhaps the most significant change the company is now making is in its pricing strategy. Always a believer in variable pricing, it trumpeted its prices as being the “lowest”. On price-sensitive items, Home Depot was always highly competitive, but on many so-called “blind” items they tried to recoup margin dollars. But manufacturers now report that the company is aggressively increasing thousands of prices to such a degree that on many lower-cost items (and even some higher-priced products) they are more than doubling their costs. In some cases it seems they are even tripling their costs.

Perhaps with an eye on the stockmarket, under Nardelli gross margins have increased from 27.6 per cent to 31.3 per cent in fiscal 2002, so there is truth to the repricing observations. Lowes, its primary competitor, has also been aggressively improving overall margins.

Tool rental departments witha separate entrance are rapidly being added to most Home Depot stores.

But while critics were second-guessing the changes being made at Home Depot, the company was reporting continuing high profits and growing sales, though at a slower pace than previously. Under Nardelli’s leadership Home Depot has amplified and refined a diversification programme that it had previously only tentatively experimented with.

Signing and lighting are vastly improved inside new or reformatted Home Depots.

The new growth strategy

As it heads into its next 25 years, Home Depot is focusing on three opportunities:

Growing the basic business by diversifying from its standard big-box format

Identifying new types of customers to be served via speciality stores

Diversifying into other related fields, which in many cases means serving volume (professional) customers

Growth will continue for Home Depot, though perhaps not so spectacularly as during its first 25 years.

Menü

Menü