For the present, the years of tremendous growth seem to be over for the UK DIY market

However, this year everything seems to be changing. Along with retailers in other sectors, the big DIY operators are struggling. A faltering housing market and concern about mounting consumer debt have led to them coming under great pressure this year. Sales figures in most non-food sectors have seen successive quarterly falls compared with previous years.

B&Q has announced a 3.4 per cent decline in same-store sales for the first six months of 2005. Profit was down by 21 per cent.

In the past the housing market has been seen as the key factor that accounted for the success of the DIY market. Meantime DIY is being regarded as a cultural phenomenon, driven by fashion trends and in particular by the popularity of TV makeover shows hosted by celebrities. Whichever is the most important factor, the truth is that in 2005 house prices are going into reverse in most parts of the country, and the TV networks are replacing DIY shows with more reality type shows. The result will definitely not be helpful to DIY retailers.

Although B&Q is still in a position of strong market leadership (approximately 25 per cent market share), the company is outdoing all others in reporting difficulties this year. This has again reached the point when rumours of the company's imminent sale have been circulating.

Recently B&Q announced declining sales and profits, and complained that it was facing the toughest trading conditions for years: escalating energy costs, higher taxes and pension contributions, rising debt burdens and a weak housing market are having an adverse effect on consumer confidence and spending power. Higher-priced articles such as kitchens, bathrooms and bedrooms are being particularly hard hit by weaker spending and the significant downturn in housing transactions. The company estimates that the market was down by two per cent in the first six months. Other retailers, including Homebase and Wickes, are also feeling the pinch and reporting disappointing sales figures this year as well. Aggravating the situation still further is the fact that some large grocery multiples (who have not yet been affected by the consumer slowdown) are increasing their presence in the non- food home products sector.

The growth of non-food categories in grocery stores seems likely to emerge as one of the biggest trends in the months to come.

DIY is regarded as a cultural phenomenon in the United Kingdom.

Grocery retailers like Asda, owned by Wal-Mart, have for some years had a significant number of non-food products in their range. Currently the focus is on decorating products, but this could be broadened to include a wide range of DIY products within the available space limitations.

The largest grocery retailer, Tesco, had non-food departments 20 years ago, though these were dropped more recently. This year the company has announced its intention to launch new non-food stores, driven by the higher margins in this segment. Initially these will be limited to clothing, electrical products and seasonal items such as barbecues. However, it is more than likely that DIY products will feature in the range before long. Most industry analysts believe that the supermarkets have only just begun their expansion into home product areas.

Nor have Homebase or Wickes been exempted from the pressures of the retail situation in the UK.

B&Q's response to the changing market conditions has been to appoint a new chief executive, Ian Cheshire, to rationalise its head office function and close a number of stores, leading to a reduction in total selling space. The aim is to produce an action programme to improve trading performance and reposition the business for the future.

A slight repositioning is already underway in the biggest Warehouse outlets. Historically these have focused on the “heavier” products and had a “trade” feel about them. Recently B&Q has recognised that this means it is losing out on valuable sales at the “soft” end of the market. Homebase has also come to the same conclusion this year and announced a new home furnishings offer.

B&Q believes that to make most efficient use of its space it needs to broaden its range and offer all the products for complete DIY projects, as well as the core DIY products it has traditionally stocked. This is being tested in a small number of stores, where the aim is to grow the “soft” DIY share of sales (with a greater emphasis on furnishings and lighting) to as high as 30 per cent.

This does not mean that the company is leaving the heavier end of the market entirely to Wickes. This year B&Q's parent company Kingfisher has established a trade division, which will develop a number of existing B&Q Warehouse stores into the new format that is based on the Brico Dépôt stores in France, which also belong to Kingfisher. With this approach B&Q is hoping to cover all sectors of the market in a way that it has not previously done.

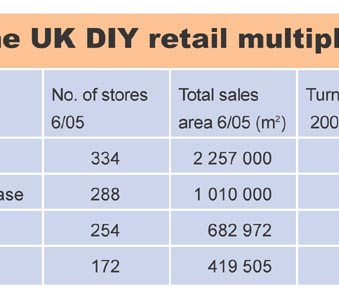

The UK DIY retail multiples(Download .pdf-file)

UK

Population: 60 mioArea: 245 000 km²Rate of inflation 2004: 1.3%Rate of unemployment 2004: 4.7%Gross domestic product 2004: € 1 716 bnReal change to GDP 2004: 3.0%

Menü

Menü