Since the beginning of this year astonishing figures have been appearing in the trade press for the number of DIY stores in Austria, which is then being hailed as the country with the highest density of DIY stores in Europe. The reason for this might be a study carried out by Regio-Plan Consulting of Vienna, in which a figure of 570 DIY stores in Austria was published

As in Germany, there is a Raiffeisen association of rural Lagerhaus cooperatives in Austria, the principal function of which originally was to sell seeds, fertilizer and feed to their farmers and to buy up and market the harvested produce. Agricultural Lagerhäuser are to be found widely distributed, even in the smallest communities with regional rail connections, but not in the larger cities. Since World War 2, the Lagerhäuser have also increasingly taken on the role of builders’ merchants, in the first instance for their farmers, while the neighbourhood supplier function has extended to food, textiles, household goods, gardening requisites and ultimately even to DIY store products for consumers in rural communities. The Lagerhaus-Märkte became typical small rural department stores with mixed product ranges to meet local needs, and ranged in style from completely antiquated to modern and attractive.

RWA, Raiffeisen Ware Austria, was Austria’s second largest builders’ merchant as recently as 1995, with sales of 465 mio euro (ATS 6.4 bn) in the building materials, home and garden sectors; food and textiles brought in a further 123.5 mio euro (ATS 1.7 bn). In 1996, a cooperative arrangement was initiated with the German DIY-Zentraleinkauf of Bielefeld, linked to a switch to a franchise system for the primary Lagerhaus cooperatives. At that point, there were 542 stores selling DIY and gardening products, but only 25 per cent (138) had a retail area in excess of 200 m² for these goods. The DIY departments were integrated predominantly into these rural department stores.

In spring 1999, RWA listed 374 Lagerhaus-Märkte with a sales area of more than 200 m² and a total retail area of 115 600 m² (310 m² on average) for the DIY and gardening product sector. Owing to the special situation of RWA with regard to distribution lines, the usual limit of 400 m² and above in respect of retail area was not feasible, and RWA did not therefore refer to “DIY stores”. Then, in the summer of 1999, the building materials/DIY and gardening products division was sold to BayWa and the name changed to AFS Austrian Franchise Systeme GmbH. This phase of undoubtedly difficult restructuring and redesign is not yet complete, and the only published details refer to 13 DIY stores with more than 1 500 m² of retail space.

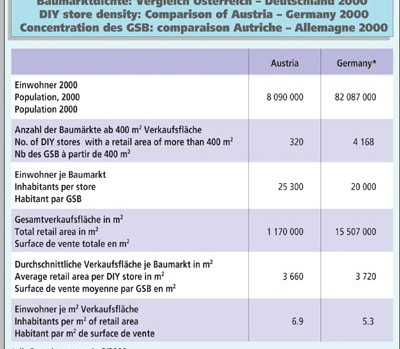

On the basis of earlier information, it can be assumed that there are approximately 40 further Lagerhaus-Märkte which can be defined as DIY and gardening stores. This increases the number of DIY stores in Austria to around 320, with an estimated total area of 1 170 mio m². Austria is still far from achieving the DIY store density of Germany in the year 2000 (see table).

There aren’t 570 DIY stores in Austria, nor will there be. Expansion is proceeding at normal levels. The DIY store groups Bauhaus, Baumax, Hagebau, Hornbach and OBI are planning to open around 20 new stores in the retail area category above 5 000 m² or 8 000 m² in the next few years. It remains to be seen what concept BayWa is developing for the Lagerhaus-Märkte which it has taken over. However, it will scarcely be possible to convert more than 50 to 60 sites to larger-format DIY stores in a short time. With this growth, Austria would then achieve the current DIY store density of Germany in four to five years.

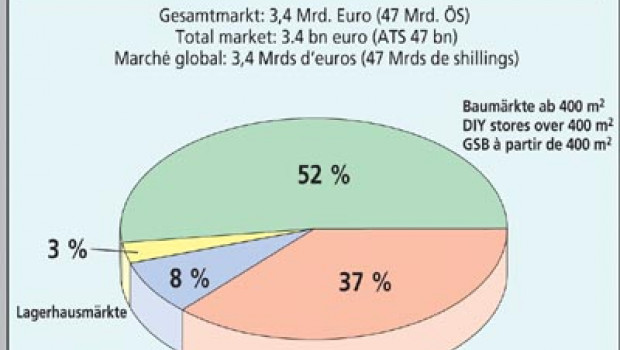

The small DIY and gardening departments of the Lagerhaus-Märkte have belonged for years to the market players with a share of the overall market potential for ranges specific to DIY and gardening stores, estimated for 2000 at 3.49 bn euro (ATS 48 bn) (not including raw materials for private house building). The various participants in the market include e.g. specialist outlets (for tools, timber, plumbing and heating, tiles etc.), garden centres, nurseries, hardware shops, interior decorators and the like. The 320 DIY stores mentioned here had a share of roughly 51 per cent in 1999. On the basis of the sales figures for 1998, a further two to three per cent could be apportioned to the many small Lagerhaus-Märkte offering a DIY and gardening range.

Heidi Biehl

Menü

Menü