A continuing trend towards large-format stores and greater efforts at foreign expansion characterise the development of the German DIY store sector

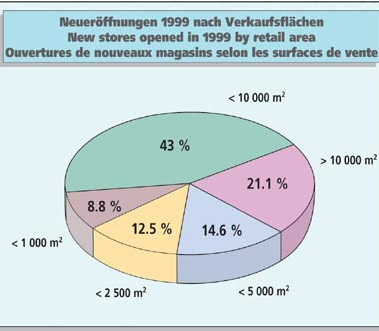

The new stores opened in 1999 confirmed the trend to ever larger formats: 21.1 per cent of all new openings had a retail area of more than 10 000 m² (1998: 17.9 per cent). In the retail area category of 5 000 to 10 000 m², a slight decline of 0.5 per cent to 43 per cent occurred compared with 1998. The number of newly opened DIY stores with a retail area in excess of 5 000 m² increased by 2.7 per cent to 64.1 per cent, whereas the proportion of stores with between 2 500 m² and 5 000 m² of sales space receded again (from 18.6 per cent in 1998 to 14.6 per cent in 1999). On the whole, however, the proportion of new outlets with a sales area of more than 2 500 m² dropped slightly compared with the trend of the previous year, as in 1998 stores in this category accounted for 80 per cent of new openings, while they only accounted for 78.7 per cent in 1999.

By comparison, the number of all new openings in the category with a sales area of up to 1 000 m² rose in 1999 to 8.8 per cent (1998: 7.6 per cent).

If stores with a retail area of up to 2 500 m² are taken together, the following picture emerges: in 1998 this category accounted for 20 per cent of all new stores, and for 21.3 per cent in 1999. Looking back to 1990, it can be seen that 53.1 per cent of new stores at that time had less than 2 500 m² of sales space.

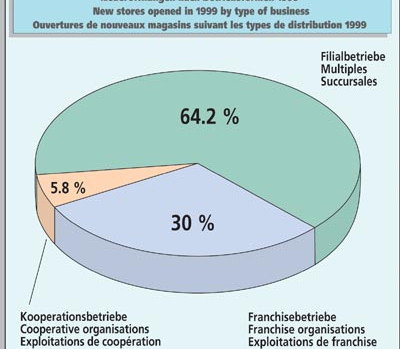

As far as new openings in 1999 were concerned, the DIY store multiples succeeded in consolidating their leading role further, with the cooperative organisations bringing up the rear. The multiples were responsible for 64.2 per cent of new openings in the year under review, compared with only 52.4 per cent in 1998. The share of the cooperative organisations fell from 8.3 per cent in 1998 to 5.8 per cent in 1999, while that of the franchise operations declined from 39.3 per cent in 1998 to 30.0 per cent in 1999.

Sales performance

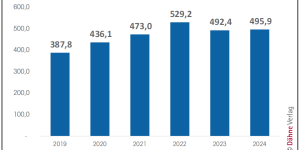

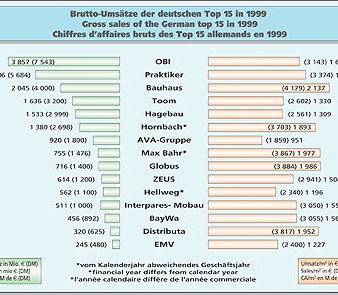

Total DIY sales in Germany rose in 1999 by 1.3 per cent overall to DM 71.26 bn, according to the Federal Association of German DIY and Building Supplies Stores (BHB) in Bonn. Specialist DIY and building supplies stores and garden centres increased their market volume by DM 760 mio to DM 42.05 bn. DIY stores in the broader sense earned around one per cent less than in the previous year with DM 9.09 bn.

Sales in stores with a covered retail area of more than 1 000 m² increased in the 1999 financial year by 2.5 per cent to DM 32.95 bn, according to the outcome of DIY Panel reporting. This increase was achieved predominantly owing to expansion in the domestic market. In spite of the positive trend for some categories of products, the sector experienced a decline of 2.0 per cent in like-for-like sales.

Product range trends

In 1999, the successful product ranges of the previous year came under pressure and some suffered a sharp decline. Core ranges in particular, such as timber, sanitation, floor coverings and wallpaper had to contend with a drop in sales of between two and four per cent. The clear winners, according to the BHB, were gardening and garden furniture, leisure and camping with growth of up to 20 per cent. The gardening segment succeeded in increasing its share of total sales by DIY stores to a good 18 per cent from 16 per cent in 1998, thus acting as one of the strongest generators of sales for the sector.

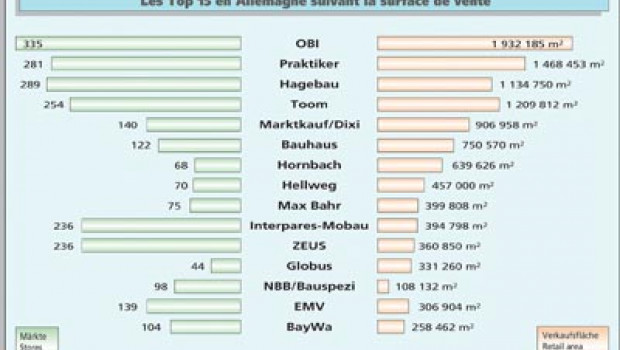

Growth in retail area

At the beginning of this year, Germany was reported to have a total of 4 168 DIY stores with a sales area of at least 400 m², 3.8 per cent more than one year previously. Although various new stores opened, the figure also includes some stores (e.g. belonging to BayWa and Interpares-Mobau) which were not previously taken into account. The total retail area estab-lished was 15 507 mio m² (previous year: 14 189 mio m²) and the average retail area was thus 3 720 m² (start of 1999: 3 545 m²). A ratio of 5.3 inhabitants per square metre of retail area was established, compared with 5.8 at the beginning of last year, with one DIY store to every 20 000 inhabitants.

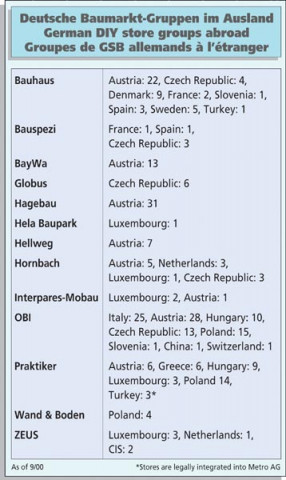

Foreign operations

Expansion in western and eastern Europe is steadily increasing. In 1999, 26.3 per cent of all new stores were established abroad, compared with 22.8 per cent in 1998. Asia has now become the focal point of German DIY store expansion: OBI opened its first store in China in mid-2000, in Wuxi. The question remains as to when DIY store groups will start becoming more active in the states of the former Yugoslavia, some of which have never been caught up in conflict, and why no-one has yet shown any interest in expanding into the Middle East.

Menü

Menü