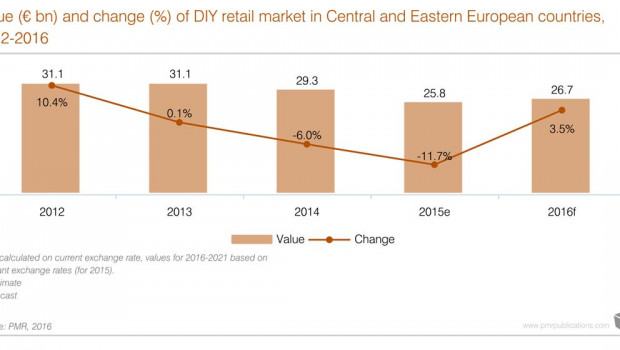

In this edition of the report, PMR again calculated not only the value of the DIY retail market but also the total value of the DIY market, including both retail and wholesale. The total market in the CEE was affected to a large extent by the crises in Russia and Ukraine and as a result declined by as much as 14.3 per cent, year on year, in 2015 to €53bn. For 2016, growth is expected in both the overall and retail-specific markets. The total market will grow more slowly due to expectations of a weaker performance of the wholesale market. However, any turmoil in Russia or Ukraine might change the situation significantly and strongly affect the market's performance.

In 2015, Russia accounted for over 40 per cent of the regional DIY retail market. Russia's share declined significantly due to the rouble's weakening, dropping in the last three years by 6 p.p. Poland gained the most market share from Russia's problems, reaching over 26 per cent as of 2015. Ukraine ranked third, but its share was only slightly larger than Romania's. The Bulgarian market is the smallest in the region and this situation is not expected to change in the next few years.

The large players

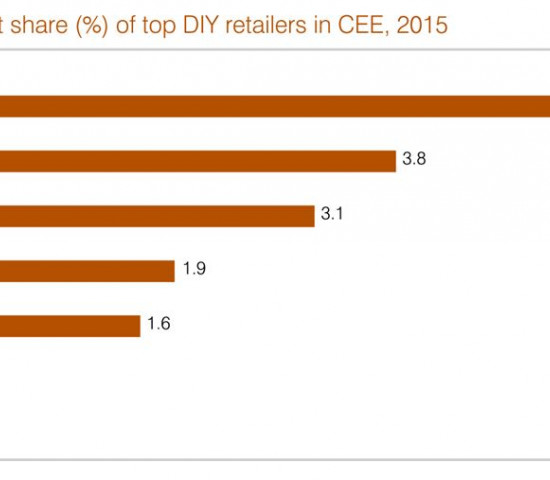

The three largest players in the region are France-based Leroy Merlin, UK-based Kingfisher (the owner of the Castorama and Brico Depot chains) and Germany-based OBI. However, they are followed by local retailers currently present only in their respective country of origin, i.e., Romania-based Dedeman and Ukraine-based Epicentr. Interestingly, the largest player in terms of store count is Poland-based PSB Mrówka, which has 208 stores in its home country. OBI has the most widespread presence, with 143 stores in five countries in the region.

DIY chains in the CEE countries

DIY chains are strongest in Romania, where nine largest retailers accounted for 45 per cent of the country's total market value. This share is expected to increase further in the next couple of years as a result of the next wave of expansion. This time, however, it will be led by international retailers. Moreover, we forecast further consolidation of the market, which will result in a decline in the number of players.

On the opposite end are Ukraine and Russia, where chains hold about 20 per cent of the market. In Ukraine, this figure will not change significantly in the next few years as almost all expansion in the country depends on the local market leader, Epicentr. However, in Russia, this share will increase mainly as a result of expansion by international retailers, which benefit from the weakening of rouble. Companies such as OBI and Leroy Merlin have investment budgets in euro, and the current exchange rate makes buying plots and constructing stores much cheaper for them.

Top DIY retailers in CEE countries. Source: PMR

Menü

Menü