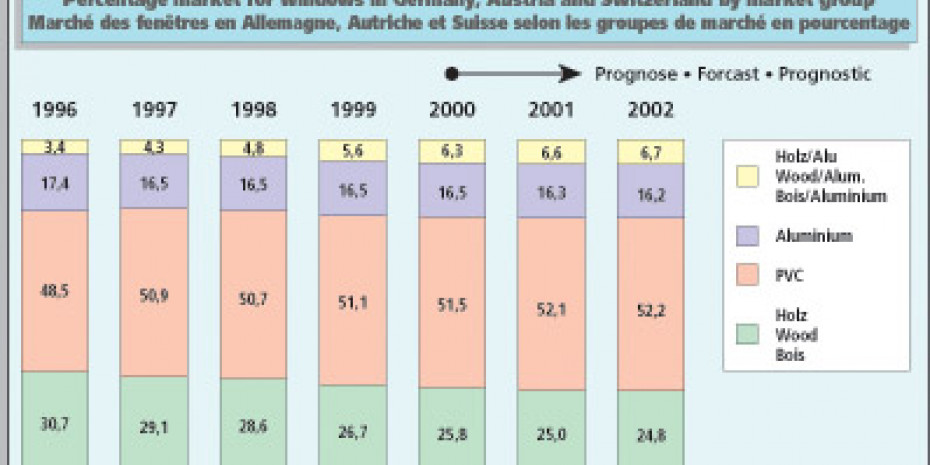

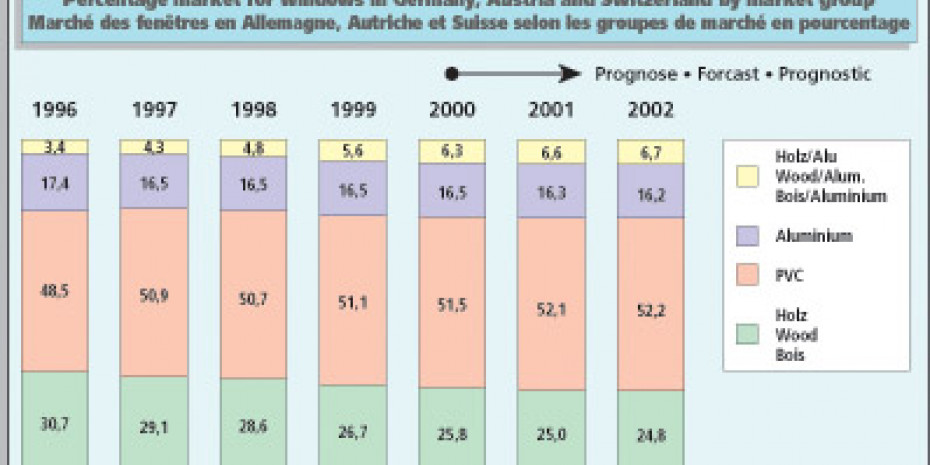

In 1999 a total of 82 mio window units were sold in Europe. The aggregate market amounts to 21.5 bn euro (DM 42 bn) by value. This indicates a growth rate of 1.7 per cent according to Inter-Connection, the Viennese management consultancy. However, the situation is all in all marked by relatively poor development in Germany, Austria and Switzerland, where an overall 0.1 per cent drop by value and stagnation in quantitative terms were recorded. The German-speaking region with its 35.6 market share is the biggest European market for windows, followed by Britain and Ireland with approx. 20 per cent, then France and the Benelux countries with 18.6 per cent. The best growth rates of up to five per cent were however achieved in northern Europe, Spain and Portugal. PVC heads the field Inter-Connection ascertained that PVC windows continued their triumphal march when it came to the material for frames. The report shows that this material attained a 40.9 per cent market share in terms of volume last year, compared with 40 per cent in the previous year. Combination wood and aluminium windows also increased their market share, though only succeeded in achieving a 4.8 per cent share of the total market volume as a result of poor dissemination in the southern countries, France and Britain. The producers of wooden windows who have switched over part of their production to wood and aluminium versions are doing very well in the market, according to observations made by Inter-Connection. Sheathing the exterior with aluminium, which provides colour-fastness and resistance to weather, is seen as the main advantage of wood and aluminium windows, along with the cosy inner frame of wood. Here in particular the management consultancy reckons with clear increases in the next few years. In comparison, wood is the only material revealed by the study to be losing market share in all regions of Europe. This is above all put down to the high level of care required by this material. It is true that aluminium windows are losing market share in central Europe, but they are still achieving a volume market share of 26.4 per cent through their strong position in the south. Quantitative distribution in Germany, Austria and Switzerland was as follows in 1999: PVC 51.1 per cent, wood 26.7 per cent, aluminium 16.5 per cent and wood + aluminium 5.6 per cent. Corresponding to the Inter-Connection forecast, these figures will have changed by 2002 in the following way: wood + aluminium should go up…