deep insights, facts & figures

Four retailers share out more than half of the Canadian home improvement market between them. Lowe’s has been considerably involved since 2007 as well

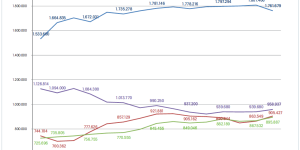

As the gateway to North America, Canada’s home improvement market has shown its quiet strength though the economic downturn. After a decade of very strong growth, the Canadian home improvement market dipped 1.5 per cent in 2008 and 3.0 per cent in 2009, holding steady at CDN $ 39.8 bn in 2010. A very slight (under 1.0 per cent) upswing is predicted in 2011, with slightly stronger results forecast for 2012. The results of the latest Hardlines Business Conditions Survey indicate an upswing in sales by both retailers and vendors. Comparing sales in 2011 and 2010, over 40 per cent of the retailers indicated their sales were up, with 35 per cent experiencing reduced sales and 24 per cent unchanged. Vendor sales were similar with 42 per cent up, 36 per cent down and 21 per cent unchanged. Significantly, 65.6 per cent of the retailers (versus 33.6 per cent at the end of the third quarter), expect sales to increase over the next six months. Four retailers represented 53.7 per cent of the Canadian home improvement marketplace in 2010: Rona, Home Depot, Home Hardware and Canadian Tire. As the largest home improvement retailer in Canada, Rona had a 15.8 per cent share of the Canadian home improvement market in 2010. It is a national publicly traded wholesale distributor and retailer, with more than 900 bannered points of sale, including dealers served by TruServ Canada, and eight distribution centres across the country. Stores within Rona are both dealer- and corporately-owned. Rona has long contended that its mix of small, medium and large stores positions its dealers to serve different customer niches. When announcing year-end results for 2011, Rona added that it is likely to close up to 20 of its big boxes, changing to a focus on “proximity” stores of approximately 3 500 m². This change is expected to begin in 2012. A major change in the Canadian marketplace was Rona’s buyout in the fourth quarter of 2010 of TruServ Canada, a dealer-owned co-operative. TruServ’s retail sales were an estimated $ 600 mio in 2010. The company’s main banner, True Value, was licensed from The True Value Company in the US. That contract has lapsed as of October 2011. In its place, Rona and TruServ have created a new banner: Tru, which was rolled out in the fall of 2011 with respect to hardware stores. Lumberyards, farm stores and a Quebec brand, Uniq, are all part of the 2012 expansion of the brand. Home Depot Canada is second behind Rona in total sales in Canada, but by far the largest…

Related articles

Read also

Menü

Menü

Newsletter

Newsletter