deep insights, facts & figures

The Italian DIY retail sector is feeling the effects of the financial crisis. But while multiples and the traditional hardware dealers are showing stability, the franchise chains and cooperative groups are plagued by problems of their own making

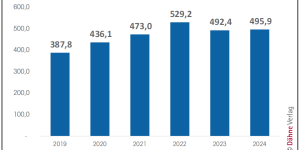

The Italian DIY retail sector, which weighs in at around € 13 bn, concluded the year 2012 without any great enthusiasm. Quite the opposite, in fact: after years of recording profits twice the size, the sector has suddenly contracted as the crunch begins to make itself felt. Of course the sector is still far from experiencing the losses suffered in other non-food areas such as domestic appliances, clothing or automobile. Nevertheless the sales curve is tending downward, thereby provoking a crisis on the production side and a “slimming effect” on the retail side, which is as ever a reflection of the market. To become aware of how things stand it is sufficient to take a look at the figures of the large-format DIY retailers. Here a process of rationalisation is being undertaken, though it is not complete by a long way. The number of DIY stores fell from 736 in 2011 to 708 at the end of 2012. That is a significant decrease, which affected the franchise chains above all. Especially hard hit was Bricocenter, an old-established Italian group that lost eight stores in the final quarter of 2012 alone – two were closed down, and six former franchisees turned their backs on the brand. But that is not all. In recent years the two operating models, franchising and cooperative, have not exactly shone in terms of corporate management and innovative ideas. Franchising is in free fall. The companies which have broken away complain especially about costs that are too high for too few services, which they give as their reason for leaving. The second type of company, the cooperative, is the victim of continuous changes so that this segment, instead of exhausting the inherent potential of the format, keeps splitting up ever further as it multiplies through cell division. Though in this process it is failing to tackle important topics like joint purchasing or a standard brand image, at least at the moment. These companies are much too preoccupied with their own limited perception and their own advantage to do more than just join forces “after a fashion” instead of working out a strategy that would in fact be common to all and standard for all partners. Nowadays the independents are good at purchasing and know how to put together a flyer. But nowadays, too, the big names seem to be the only ones capable of implementing campaigns designed to boost sales. A good idea must not necessarily always be linked to the size of a brand and its economic strength. Rather it is dependent on…

Related articles

Read also

Menü

Menü

Newsletter

Newsletter