deep insights, facts & figures

The foreign subsidiaries of Praktiker haven’t gone bust like their parent company, but they are just meandering along like in Poland. A solvent prince would be just the job

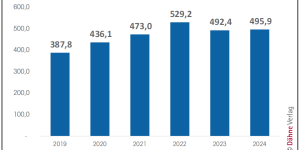

The story could have a traditional beginning: “Once upon a time there was a German DIY retailer who wanted to be the number one. Not only in Germany, but in many other countries as well, especially in eastern Europe.” The emphasis is on “Once upon a time”, because the goals that Germany’s meanwhile insolvent Praktiker DIY company once set itself are now obsolete. The same applies to its involvement in Poland. It was in 1997 that Praktiker opened its first DIY store in Poland. Those were the days when ‘Fokus’, a news magazine, could rejoice in a study of Praktiker’s international commitment that “Germany’s second-biggest DIY chain is seeking its salvation in the East. While sales at home continue to shrink, Bulgaria, Greece and Albania are seen as a new Eldorado. Almost one in four Praktiker stores will soon be abroad. Business beyond the national boundaries is contributing more than half of its operating profit.” Moreover, profit from the branches of Praktiker in Poland and the Czech Republic amounted to around 30 per cent of total profits at that time. The chain’s image abroad was also completely different, with the emphasis on ‘advice and service’ instead of the discounting practice in Germany, according to Fokus. However, with a current total of 25 outlets and a combined sales area of some 195 000 m², Praktiker is no more than meandering along in Poland. By contrast, Bricomarché has almost doubled its number of stores within five years, as well as its sales area, while market leader Kingfisher (Castorama/Brico Dépôt), Groupe Adeo (Leroy Merlin/Bricoman) and Obi are all experiencing strong expansion. Only Nomi, the local player, is showing similar signs of weakness. Why, Kingfisher opened two new stores in Poland in the first half of the current financial year alone (2013/ 2014). According to a survey, the international DIY chains satisfy around half of the demand for DIY store products in the country, while domestic wholesalers such as Polskie Sklady Budowlane (PSB, or ‘Polish Builders’ Warehouse’) supply the rest. In recent years PSB has built up the Mrówka (‘Ant’) retail chain within an extremely short time to the current total of 144 outlets in small and medium-sized town centres. The competition to Praktiker was and still is becoming stronger rather than weaker. For a long time Poland succeeded in remaining aloof from the downward pull of the economic and financial crisis. The economy continued to grow and consumption remained relatively stable…

Related articles

Read also

Menü

Menü

Newsletter

Newsletter