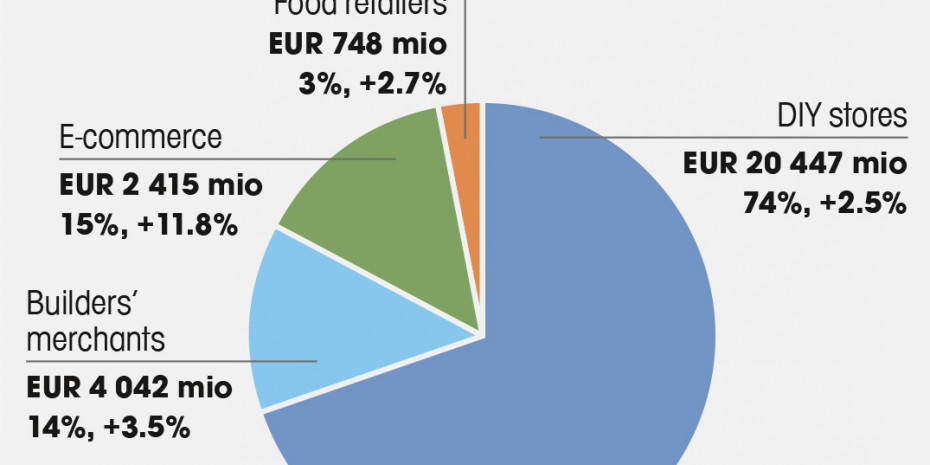

Justifiably and relievedly, the associations of DIY stores and manufacturers FMB and Inoha speak of a market recovery: the French DIY market grew in the year 2019 by 3.4 per cent to an overall volume of EUR 28 bn; in the year 2018 there had only been an increase of 0.4 per cent.

The positive development also continued into January and February 2020 according to the associations, but was then stopped by the coronavirus pandemic and the shutdown in France. The industry now hopes that consumers will continue with projects which were initiated but not previously completed, which stem, among other things, from the high transaction figures on the second-hand property market. Because the number of these transactions rose in June 2019 above the one million mark in terms of the respective past twelve months. And consumer confidence also grew in the year 2019.

This spurred the DIY market overall. However DIY stores hadn't participated in the overall growth of 3.4 per cent to this amount. Their sales grew by 2.5 per cent to a volume of EUR 20.447 bn (74 per cent of the overall market).

Within the DIY retail industry, the balance of powers from the previous years has continued. Leroy Merlin built up its market leadership among the DIY stores and increased its market share by one percentage point to 37 per cent. The two other sales channels in Groupe Adeo - Weldom and Bricoman - continue to maintain 4 and 3 per cent respectively. Down one percentage point each is the market share of the two sales channels in the Kingfisher group: Castorama now amounts to 14 per cent, Brico Dépôt 13 per cent.

Menü

Menü

Newsletter

Newsletter