Home Depot operates big boxes in Canada just like in America.

Today the bulk of the market rests in the hands of a few, very powerful retail organisations. The top four alone make up almost half of home improvement sales in the country. These four are Home Depot Canada, one of six divisions of Home Depot throughout North America, followed by Canadian Tire, Rona and Home Hardware Stores. Each of these companies had sales of around CDN $ 4 bn in 2003, with Home Depot ahead of the pack representing an estimated CDN $ 4.5 bn.

Canada’s Top Four

Aside from their sales, Canada’s top four DIY companies have very little in common. Home Depot Canada, like its operations in America, is a big box retailer only, with more than 100 stores across the country and sales averaging about CDN $ 40 mio per store.

Canadian Tire is a publicly traded wholesale distributor that supplies 450 affiliated dealers in Canada. Despite its name, these stores sell hardware, leisure products and sporting goods, as well as automotive supplies. Its overall sales actually exceed CDN $ 8 bn, but sales of hardware, housewares, lawn and garden and leisure products, which represent its share of the DIY market, make up less than half that amount. Canadian Tire is a tradition in Canadian communities, and the company claims that 80 per cent of Canadians live within a 15-minute drive of a Canadian Tire store.

Canadian Tire achieves about 50 per cent of sales from DIY products.

Rona, originally a dealer-owned cooperative group, is now a publicly traded wholesale distributor too. The infusion of cash resulting from the initial share offering in November 2002 has fuelled Rona’s expansion plans. Its structure includes both traditional hardware stores and building centres. What is more, the company decided four years ago to become a key player in Canada’s big box home improvement market. Today it has more than 63 such stores, some of them owned by syndicates of dealers, and the majority corporately owned. Today Rona’s retail sales exceed CDN $ 4 bn.

Home Hardware Stores is the most traditional of the top four organisations. As a dealer-owned cooperative wholesaler it comprises almost

1 000 stores, ranging from hardware shops and DIY stores to builders’ yards. It also includes 50 furniture stores. The cooperative’s greatest strength is in secondary and rural markets.

New competitors

Apart from the continued onslaughts of Home Depot and the efforts of Rona to open new stores in a variety of formats, Canada’s DIY retailers face new competitors. Sam’s Club, the warehouse-style operations of Wal-Mart, arrived at the end of 2002 with six stores in Toronto, Canada’s largest city. This chain is expected to grow to 60 locations, matching the presence of Canada’s only other warehouse club operator, Costco.

Help for both DIYers and professionals is available at the service counter.

But independent DIY retailers will continue to defend their markets. Many of them are well entrenched in rural markets that are not viable for big boxes. They are also driving consolidation, as they add new stores or buy up the operations of their competitors.

Most independent hardware stores and a number of building centre dealers belong to one of the cooperative retail groups such as Home Hardware or Rona. But many of the builders’ merchants belong to one of the dozen or so buying groups that negotiate lower prices for lumber and building materials for their members. The largest of these groups are Independent Lumber Dealers Cooperative (ILDC), Sexton Group and Tim-BR Marts.

Trends in Canadian DIY retailing

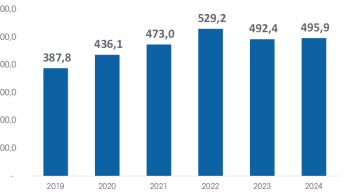

The industry grew by almost nine per cent in 2002, and another seven per cent in 2003. Despite an anticipated slowdown in the new housing market, growth is forecast to remain at six to seven per cent in 2004 too.

Two very different customer types have emerged as key drivers of this growth: contractors and women. A new study by Hardlines reveals that women are more important than ever as decision makers, on not only the kind of home improvement projects to be undertaken, but which stores to shop in for the supplies as well.

The big box stores are very successful at delivering options that include décor and soft DIY items. Almost half of all women surveyed choose to buy hardware and home improvement products at stores like Home Depot and Rona Home & Garden (Rona’s big box banner). That is considerably up since 2001, when just 32 per cent of women preferred a big box as a shopping destination.

This Rona building centre opened last year in Ontario.

On the other hand, professional and contractor customers remain the major source of high volume building materials sales. Independent dealers have typically been in a better position to supply the local needs of builders and renovators than the big boxes. However, Home Depot is making builders a priority for expanding its Canadian operations. Nevertheless, these sales still account for less than one-fifth of Home Depot’s Canadian sales, and growth in this field will be a challenge for the company in the long term.

One of the factors keeping contractor sales strong is the health of the new housing market, which has enjoyed record growth over the past four years. The forecast is for it to remain strong in 2004 as well, although slightly lower than last year’s record high. Even as the housing market remains healthy, Canada’s housing stock continues to age, putting pressure on homeowners to renovate and repair. Whereas new housing once made up the bulk of DIY sales, repair, renovation and décor sales now constitute about half of the market.

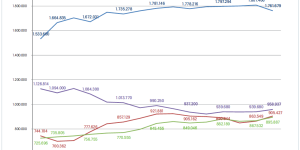

Candian DIY market by store type (2003)(download pdf-file)

Menü

Menü