B&Q is the biggest DIY retail group in Taiwan. At the end of 2004 the British company had 18 outlets with a combined retail area of 90 000 m²

Available in B&Q’s stores are 30 000 items in 22 product categories. These include paint, adhesives, wall coverings, tiles, flooring, lighting, kitchens, furniture, bathrooms, plumbing, building materials, hardware, tools, automotive, timber, seasonal lines, housewares, window décor, shelving, electrical and gardening, as well as books and magazines. Ninety-five per cent of the products are sourced from Taiwanese suppliers, who in turn import 50 per cent of their goods from China.

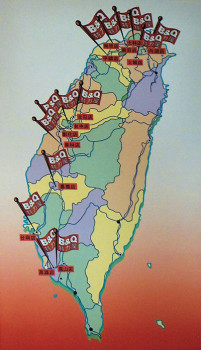

B&Q is represented in the north and west of the country.

The programme also includes private labels. The company intends not only to satisfy a variety of customer wishes by offering this possibility, but also to reinforce its leading market position. Five own brands are available: “Eco” covers the aggressively priced entry segment, “B&Q Value” stands for good quality at permanently low pri-ces, “Omni Guard” is for health and safety, “B&Q Colours” for paint, and “B&Q” covers the medium price range. There are plans to launch two more own brands in 2005, with the aim of increasing their overall share of sales from 6.82 to 13.2 per cent. Among the own brand products are paint, adhesives, flooring, lighting, tools, window décor, plumbing, electrical, furniture, shelving and seasonal lines.

“Although the range in Taiwanese DIY stores is similar to that available in American or European outlets, we have a softer store format,” explains Mariusz Gliwinski, chief executive officer of B&Q Taiwan. Crucial here is the fact that purchasing decisions are being made by women. Lighting is proving to be the top-selling product category in Taiwan’s B&Q stores.

Market studies and customer satisfaction surveys are carried out every year so that the product assortment can be geared to meet customers’ expectations. What is more, the ranges are reviewed on an annual basis in order to improve space productivity. “We are also increasing the direct import mix and making use of synergies with the Kingfisher group in order to bring the latest DIY and lifestyle trends from Europe to the Taiwan market,” explains Mariusz Gliwinski.

Only eight per cent of Taiwanese customers are DIYers, around 17 per cent go for BIY and have the work done for them, and over 70 per cent are contractors. People in Taiwan tend to know very little about DIY and cannot understand that it might be fun to do or worth undertaking for economic reasons. Consequently B&Q offers customers more comprehensive solutions that include free measuring and delivery services.

1996 saw the launch of B&Q’s first DIY store in Taiwan; today’s total is 18.

B&Q’s expansion plan for Taiwan envisions two or three new openings every year. The latest store, which opened at the end of November 2004, has a retail area of 7 000 m². Located on the fourth floor of a shopping centre, it is the sixth such store in the Greater Taipei area.

Consideration is being given to entering the internet sales market, since 50 per cent of the population of Taiwan have access to a computer, and the overall size of the online market amounts to NT $ 26 bn (€ 612 mio) annually. “And that is very attractive,” comments Mariusz Gliwinski. “However, we are also evaluating other store formats and customer segments, through concentrating more strongly on regional requirements, for instance. We are also looking at catalogue sales, though that is not our top priority.”

Own brands currently account for 6.8 per cent of sales.

B&Q intends to increase its market share to 10 per cent in 2004, from 9.6 per cent in 2003. The economic framework is a difficult one: expenditure by private households was down by 0.9 per cent over 2002 and 2003 as a result of the Sars infection. Even though economic growth of 5.41 per cent is expected for 2004, following 3.24 per cent in the year 2003, growth of no more than 2.97 per cent is forecast for individual consumer expenditure.

The Greater Taipei area still continues to offer the most favourable investment conditions in terms of population density, household income and consumer habits. However, the south of the country is becoming increasingly interesting to investors, and B&Q is investigating whether new opportunities might open up here for other store formats tailored to the regional requirements.

Menü

Menü