The spending formed part of overall investment by consumers on residential construction in Canada, which totalled C$ 19.3 bn (a rise of 6.7 per cent on the second quarter of 2004). Residential construction spending since the beginning of 2005 totalled C$ 34.5 bn, a 7.5 per cent increase compared to the first six months of 2004, according to data published in September 2005 by Statistics Canada.

“Low mortgage rates and their positive impact on affordability, high employment levels and strong consumer confidence were among the factors contributing to housing demand,” said Statistics Canada. “Rising house prices also contributed to the increase in the level of residential construction outlays.”

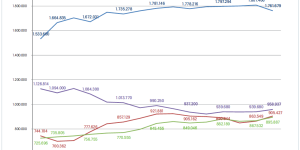

Taking June as a snapshot month, spending on hardware and home renovation products at Canada’s fleet of large retailers rose by 7.5 per cent in June compared to the same month a year ago. Canadian consumers spent C$ 160.6 mio at the checkouts of Rona, Canadian Tire and other DIY giants in June 2005. And in May this year, spending was at a similar level.

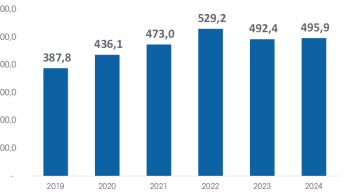

Over the past five years, sales of home renovation products have soared – from C$ 1.54 bn in 2000 to C$ 1.84 bn last year. A survey completed two years ago – the most recent available from Statistics Canada – put low interest rates, strong employment growth, higher disposable incomes, and shortages in the rental and resale housing markets as the key reasons for homeowners in Canada spending C$ 23.4 bn in total on repairs and renovations in 2002.

Canadian home renovation operator Rona recorded the best quarter in its history earlier this year. Net earnings for its second quarter were C$ 70.4 mio, a 31.1 per cent increase over the record quarter last year. This growth was fuelled by the expansion of its corporate and franchised networks, the recruitment of affiliated stores, an ongoing improvement in operating ratios and the Totem acquisition concluded early in the quarter. Same-store sales were up 0.6 per cent, or 1.1 per cent excluding the deflation resulting from the drop in construction material prices, according to Rona.

“Overall, economic conditions are favourable to our line of business. Canadian GDP grew 2.7 per cent in April over the same month last year,” said Rona when reporting its second quarter. “The Canadian Real Estate Association reported record home resales in the first half of 2005. Although down from last year, housing starts nevertheless remained historically high. Retail sales continued to advance in the second quarter year-over-year, as did renovation and hardware products.”

DIY retailer Canadian Tire enjoyed retail division sales increases of 4.2 per cent, to C$ 1.9 bn, during the second quarter of this year. The company overall reported second quarter net earnings of C$ 92.2 mio, an increase of 14.1 per cent compared to C$ 80.8 mio in 2004. On the retail side, the company said that housewares, power tools, and lawn and garden categories experienced the strongest growth.

During August 2005, Canadian Tire officially opened the doors of a new 5 800 m² flagship store in downtown Vancouver, British Columbia. It forms part of Canadian Tire’s broader strategy to accelerate the replacement of traditional outlets and build new, more modern stores.

Residential construction has also been strong. After expanding rapidly in 2003 and 2004, the pace of residential construction appears to be moderating, but it remains at a remarkably high level of activity. The strength in new and resale housing markets has contributed to consumer spending by boosting demand for consumer durables (like furniture and appliances), but also by raising household wealth through climbing home prices.

South of the border, DIY giant Lowe's Companies Inc. is expanding further, too. Lowe’s is to invest around US $150 mio in expanding its distribution network.

Paul HarrisFreelance journalistCDN-West Vancouver

Menü

Menü