Pro-oriented, residentially focused construction supply companies saw 22 per cent fewer deals in 2023, but the number of locations acquired declined just 2.6 per cent from the year before, Webb Analytics' just-released "Deals Report for 2023" finds. At the same time, the number of greenfield openings dropped only 5 per cent.

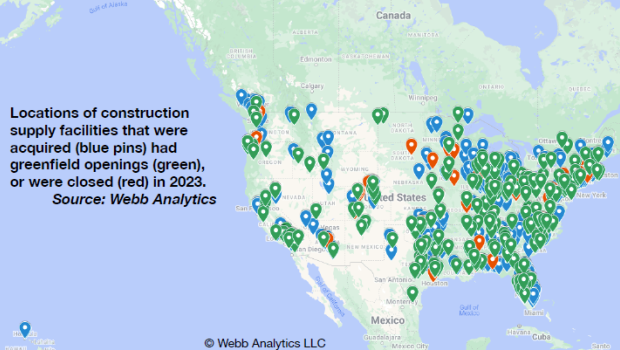

This year's edition of the consulting company's annual report counts 140 merger and acquisition transactions last year by 82 entities and involving 479 locations. That compares to 179 deals by 89 buyers for 492 locations in 2022. Meanwhile, there were 242 greenfield store openings in 2023, not far behind 2022's 255 openings of new stores.

"The desire to consolidate the construction supply industry didn't wane in 2023," Webb Analytics President Craig Webb said. "However, the jump in lending rates made it harder for some to finance deals. That's a likely reason why some of the privately held companies that were active in previous years didn't announce any purchases until late in 2023. Meanwhile, three of the four busiest acquirers were publicly held companies."

The Deals Report for 2023, available for free at www.web-analytics.com, covers actions involving the types of companies where a pro would shop. These firms include lumberyards (and their components plants that make trusses, panels, and millwork), roofing stores, drywall specialists, landscaping companies, flooring retailers, home centres, and hardware stores. The report covers only actions in the U.S. except when a U.S.-based dealer moves into Canada, as happened a few times in 2023.

When it comes to the hardware stores and home centre segment, the report states that, unlike past years, there wasn't a major purchase of hardware stores: 34 deals landed just 41 facilities. Ace Hardware opened eight stores under its Westlake Ace Hardware brand and three more under Great Lakes Ace Hardware. This category was also notable for its 27 reported store closures. The vast majority shut down because the owner wanted to retire, according to the report.

The biggest news in this sector came from The Home Depot, which announced in November the purchase of 44 International Designs Group stores. All specialise in tile, stone, and appliances, and provide new outlets to serve pros and their high-end customers.

Menü

Menü