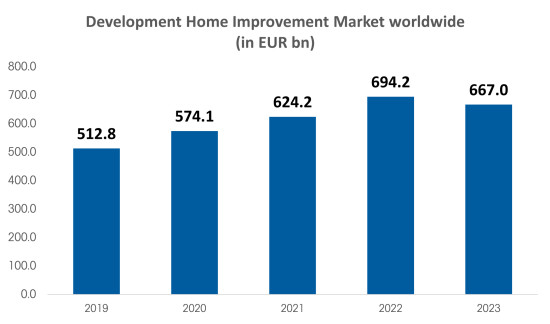

The global home improvement market experienced a difficult year in 2023, reaching a level of 667.0 billion euros. Compared to the previous year, this represents a contraction of 3.9 percent for the home improvement industry. The decline was preceded by a 35.4 percent overall growth of the global market between 2019 and 2022, which corresponds to an annual growth rate of 10.6 percent.

The global market in euros was only saved from an even sharper decline by growth of 4.1 percent in the Asia-Pacific region – and here in particular China with plus 11.3 billion euros (+9.1 percent) in 2023. All other world regions were in the red. In euro terms, the regions of Africa/Middle East and North America experienced a particularly sharp decline of 12.6 percent (previous year: minus 1.1 percent) and 8.4 percent (previous year: plus 18.9 percent) respectively. The market in euros also shrank, albeit less sharply, in Latin America by minus 4.8 percent (previous year: plus 4.9 percent) and in Europe by minus 3.5 percent (previous year: plus 6.3 percent).

“2023 was not a good year for the global home improvement industry,” explains Michael Greiner, the editor at Dähne Verlag responsible for the new Home Improvement Report. “After the industry experienced an extraordinary boom worldwide during the Corona crisis and shortly thereafter, we are now seeing the delayed toll that the multiple crises worldwide are also taking on DIY stores and the home improvement industry.”

The figures are taken from the new Home Improvement Report Retail Worldwide, which was produced in collaboration with the international DIY store trade associations Edra/Ghin, the international manufacturers' association Hima and Dähne Verlag.

“Reliable figures are particularly valuable in turbulent times. This edition of the Home Improvement Report also aims to accurately measure and validly process the global retail landscape,” says Reinhard Wolff, President of the international manufacturers' association HIMA (Home Improvement Manufacturers Association). “Special thanks again go to our partners in the associations and the many companies worldwide that have contributed to the new report by providing their figures,” explains John Herbert, General Secretary of the international DIY trade association Edra/Ghin (European Home Improvement Association / Global Home Improvement Network).

The overall increase in China in 2023 of 9.1 percent is based on figures from the national statistics authority on direct sales by factories and their associated distribution structures to end consumers, tradespeople and construction companies. These rose last year by 16.3 percent to 113.7 billion euros. By contrast, the retail sales in the home improvement sector, which are reported separately by the statistics authority, fell by 17.4 percent to 21.6 billion euros in 2023.

Only Asia among the world regions in positive territory

In 2023, North America was still by far the largest market for the home improvement industry, with 308.7 billion euros. However, sales here shrank by 8.4 percent in euro terms. In real terms and in local currency, only Mexico managed to achieve growth, while the United States and Canada shrank. Mexico saw an increase of 3.5 percent. In the world's leading market, the USA, real and local currency sales fell by 9.9 percent in 2023, and by 7.4 percent in Canada.

The picture was different in the world's second-largest region, Asia-Pacific. Several major home improvement markets saw strong growth in real terms and in local currency, including Indonesia (+24.4 percent), China (+17.9 percent) and Thailand (+9.2 percent). With a market volume of around EUR 136 billion, China has established itself in second place behind the USA, with a market volume of around EUR 278 billion.

In Europe, the home improvement market grew most strongly in real terms in Bulgaria (10.8 percent), followed by Portugal (5.0 percent) and Russia (3.5 percent). The largest European markets in Germany, France and the United Kingdom saw a decline in real terms of 9.6, 8.7 and 7.8 percent respectively. In 2023, the sector generated a total of EUR 28.9 billion in Germany, EUR 21.8 billion in France and EUR 16.7 billion in the United Kingdom. The biggest drop was seen in Eastern Europe. In Belarus, the sector fell by 35.6 percent, in Lithuania by 32.9 percent and in Finland by 23.7 percent.

The performance of the major home improvement retailers in 2023 was also poor. With Groupe Adeo and its 0.9 percent increase, there was only one company among the top 20 home improvement retailers worldwide with nominal growth; all the other 19 companies saw their sales shrink last year. In total, the top 20 retail companies generated a turnover of 384.2 billion euros in 2023. The list is again led by Home Depot with 141.2 billion euros and Lowe's with 79.9 billion euros from the USA, followed by Groupe Adeo with 31.8 billion euros from France.

Unique statistics

The new Home Improvement Report Retail Worldwide is more than 300 pages strong and has been compiled for the second year in a row in close collaboration between the global trade (Edra/Ghin) and industry associations (Hima) and Dähne Verlag. The 2024 report is based on figures for 621 home improvement retail chains from 72 countries worldwide and thus provides a unique insight into the development of the global DIY industry.

In addition to the new Home Improvement Report Retail Worldwide, Dähne Verlag has also published the underlying data collection Home Improvement Retailers Worldwide in the versions Europe and Worldwide. This examines in detail 650 retail companies worldwide in terms of sales, locations and sales areas and provides an overview of the international sales line and group network for each home improvement company. The data collection also contains entries for more than 1,300 management functions of retail companies worldwide, as well as the addresses of the company headquarters.

The new Home Improvement Report 2024 and the data collection Home Improvement Retailers 2024 can be ordered individually or as a package from Dähne Verlag, or for association members from Edra, Ghin and Hima or their national associations.

Purchase

HIMA members can contact jasmin.menten@himanetwork.org for the purchase.

Home Improvement Report Retail Worldwide 2024

The new statistics report for the international DIY industry

In collaboration with EDRA /ghin und HIMA

- It shows sales trends, location figures and floor space turnover of more than 600 distribution lines worldwide.

- The report covers the top 20 companies worldwide in detail.

- In detail, it analyses more than 53 national markets, with data on turnover in the DIY and home improvement sector.

- The new report contains all companies, countries and overviews as in the previous Home Improvement Reports, published by HIMA, EDRA/ghin.

Solid data.

From real experts.

Menü

Menü