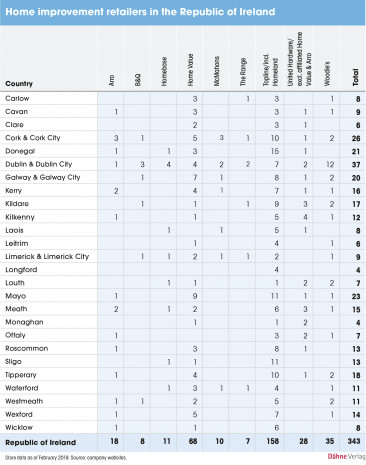

The undisputed market leader is a native company: Woodie's DIY, with its 35 locations covering a retail space of around 116 000 m². That is an area which is almost twice the size of the number two: the B&Q chain in the British Kingfisher group is still represented in Ireland with eight stores.

In third place of retail space ranking with eleven locations is Homebase, again a British chain which did belong to Bunnings in Australia for a while until the Australians, after not even two years, all of a sudden withdrew from the European market mid 2018. There is a third company from Great Britain which has gained a foothold on the smaller neighbouring island: The Range now operates seven locations in Ireland.

In addition to these DIY retailers with large-scale stores, Ireland still has a strong specialist trade scene in the hardware sector, some of which is combined into cooperatives and buying groups.

The largest group on the basis of number of locations is Amalgamated Hardware. The approximately 80 members with their 158 businesses mainly operate under the retail brand Topline as well as under Homeland.

At second place among the cooperatives is the United Hardware group with a total of 114 stores. The largest share of these are attributed to the retail brand Home Value with 68 stores. Particularly prominent as brand are also the 18 Arro Home, Garden & Build stores, which are overseen by United Hardware.

Also, the independent chain McMahons needs to be mentioned: a 100 per cent Irish-owned company. Just like the Topline cooperative, including the Homeland stores, McMahon is also active in Northern Ireland which is a part of the UK.

The geographical distribution of the home improvement centres and hardware stores also holds a few surprises in comparison to the findings in other European countries: in relation to the respective number of inhabitants per county, the DIY store density is lowest in the larger cities.

Menü

Menü

Newsletter

Newsletter