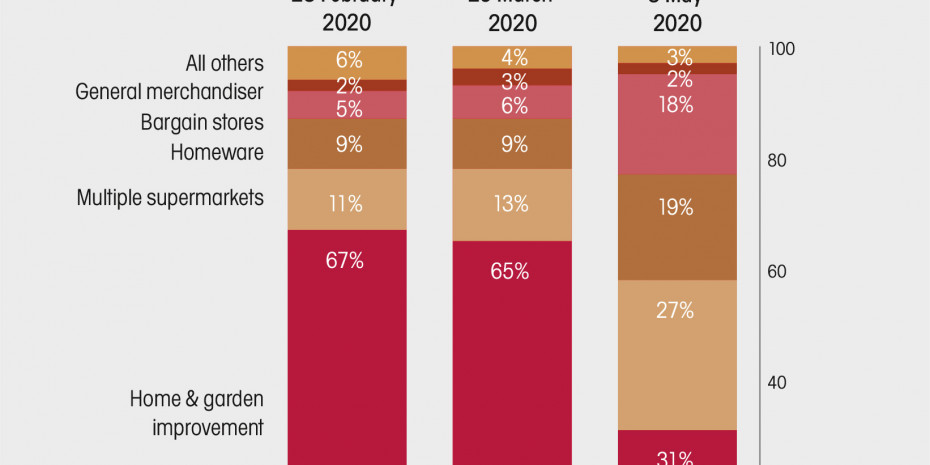

Opening up online

Now, we don't expect this incredible online demand to continue. We know that most home-improvement shoppers still want to touch and feel products before purchasing and that physical stores and knowledgeable staff remain important. In fact, big DIY stores and garden centres saw a sharp increase in footfall when they started to reopen in the days leading up to 1 June. As a sector based on fewer, larger stores, the main players have been able to adapt quickly to social distancing and safety guidelines and were rewarded with pent-up demand and long queues of shoppers.

But lockdown has served as a reminder for how new, in particular younger, customers like to shop. And it has signalled that retailers need to invest in enhanced digital platforms to support their bricks-and-mortar outlets. Are they doing enough to capitalise on the popularity of interiors and home-improvement content on sites like Pinterest and Instagram, and allowing people to move seamlessly between scrolling for 'inspo' and making a purchase? Young shoppers expect to see wallpaper on an influencer's wall, and have it land on their doorstep the following day.

Of course, there's a balance to strike between online and offline. Large out-of-town stores are more suited to social distancing and to what will, almost…

Menü

Menü

Newsletter

Newsletter