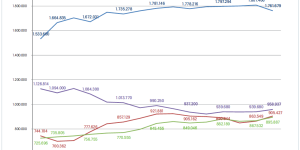

Domination of retailing by the three leading players continues to be the main feature of the British DIY market. Pricing is becoming increasingly important as the basic selling strategy

But there is now greater competitiveness in the market and also a new air of fragility. The war in Iraq, the Sars epidemic and increasing concerns about the economy, particularly with regard to the manufacturing sector, have combined to cause an erosion in consumer confidence for the first time in several years.

In order to maintain consumer interest, retailers have been keen to adopt Everyday Low Pricing (EDLP) strategies, increase the volume of own brand and also introduce more products of lower quality. While this has undoubtedly led to competitive pricing in-store, it has also put branded suppliers under enormous pressure. Manufacturers in all sorts of areas have been in difficulties, ranging from wallcoverings through housewares to power tools.

Sales at B&Q, the number one retailer, are over 900 mio euro higher than both competitors’ combined.

Danger from price wars

The UK market has always been regarded as the most price-sensitive in Europe, but some in the trade question whether the current “dumbing down” is in the long-term interest of the industry. A strong and vigorous supply base is key to the future success of the sector. Retailers need the innovation provided by suppliers and in fact frequently demand it. Constant price pressure on the supply base sometimes forces the development of innovative products to take a back seat – something which the consumer ultimately will not benefit from.

B&Q’s new retail format

B&Q of course remains the UK market leader with 320 stores. This year the parent company Kingfisher has made plain its intention to concentrate solely on the home improvement market across the world: it has sold a number of non-core businesses in the UK and overseas in furtherance of that aim.

B&Q, or rather Kingfisher, is the only British retailer with interests outside the UK, and these have grown considerably in importance – the company now owns 100 per cent of Castorama and 25 per cent of German retailer Hornbach. This is not to mention DIY stores in Belgium, Italy, Poland, Ireland, Turkey, Brazil, Canada, Taiwan and China. Kingfisher can now claim to be Europe’s leading DIY retailer.

For the past several years B&Q has gone forward on two platforms, Warehouse and Supercentre. This is now becoming three. Although the main engine for growth is the very large Warehouse store, the company recognises that there are important locations which are not big enough to support a store of Warehouse proportions. Hence the new Mini Warehouse concept.

Wickes Extra in Barking is the company’s first Warehouse-style store.

Theoretically part of the Supercentre chain, this includes many features of the Warehouse concept, including a focus on projects and strong appeal to the trade customer, but on a scale appropriate to small market towns.

New directions for Focus Wickes

Focus Wickes, the number two retailer in the UK market, actually has more stores (428) than the market leader. However, the sales of its two trading brands, Wickes and Focus, amount to far less than those of B&Q.

Wickes appeals to the more serious DIY enthusiast and the trade customer, while Focus, which includes the old “soft DIY” businesses of Great Mills and Do It All, aims more for the home enhancement market. The company is still busy integrating the two businesses into the overall structure while maintaining and developing their distinct USPs.

The history of merged businesses has not always been a successful one in the British UK market, but Focus Wickes is clearly intent on getting it right. This year the company has taken on a new management team which comprises many new recruits drawn from senior positions at other well-known retailers.

This year Wickes is opening Warehouse-style Wickes Extra branches. These are roughly twice the size of a normal Wickes store and feature expanded product ranges in a number of categores including lighting, flooring and power tools. The company aims to open ten Wickes Extra stores a year between now and 2006 as the result of new openings and extensions to existing units.

B&Q’s Mini Warehouse, a new format for small market towns.

This year has also seen a first Wickes Showroom established within a Focus store, an idea that it is hoped to repeat in order to provide a Wickes presence in locations with no full Wickes store.

Elsewhere Focus is continuing to revitalise its business with a new development plan which involves enhancing the company’s professionalism and concentrating on core strengths. The implementation of category management and a complete review of suppliers are currently being undertaken.

A new roof for Homebase

Homebase, the number three in the market, is also undergoing change – although seemingly in stable ownership for the first time in several years. Part of the Argos retail group since the end of 2002, Homebase is now being positioned alongside Argos, the UK’s most successful mail-order retailer.

The group is now looking to reap the benefits of integration, while also developing key aspects of the Homebase business. These will include more stores with mezzanine floors, areas which are used for the display of kitchens, bathrooms and home furnishings. In contrast to other retailers who have tried them in the past, Homebase finds these areas to be successful and currently has 36 of them, with plans to implement another 35 to 40 in the coming year.

Three big players dominat the market(download pdf file)

United Kingdom

Population: 59 mioArea: 245 000 km²Rate of inflation 2002: 2.9 %Rate of unemployment 2002: 5.2%Gross domestic product 2002: M 1 455 bnReal change to GDP 2002: 1.5 %

Menü

Menü