2. Germany also had the highest per capita spend at € 698 in 2004, while Poland saw the lowest spend at just € 123 in the same year.

3. Around 6 in 10 people in the UK (61 per cent) and France (56 per cent) do some form of DIY, making it almost twice as popular as in Germany (32 per cent) and Spain (31 per cent). Even though less people try their hand at DIY in Germany, those that do, spend significantly more than their European counterparts, which explains the success of the German retailers.

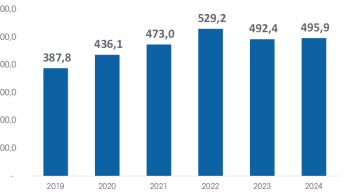

4. Following the high of 2003, the rate of growth within the DIY sector has slowed, with sales stabilizing in recent years. The main reasons for this are the economic slowdown in most of Europe and the fact that today there is far less scope to open new stores.

5. There is still interest in appearances and new fashions in the home. Consumer research finds that French consumers are particularly interested in home fashions with over 54 per cent of the French stating that they look at magazines to give them inspiration for their homes. Nearly as many, 51 per cent, say they are always on the lookout for new ideas to improve their homes.

6. The major challenge for the sector is the ageing population, created by the long-term combination of falling birth and death rates. Mintel proposes that the DIY sector must now adapt to the changing nature of the consumer for the future success of the market. The DIY stores must continue to reposition themselves as general homeenhancement outlets, rather than somehow specifically associated with DIY. The ageing population needs to be given new reasons to visit DIY stores, and will be more attracted to the softer end ranges.

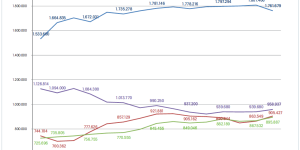

7. Kingfisher is far out in front in the European DIY sector, with pan-European sales of € 11.3 bn in 2004. Number two with sales of € 5.5 bn in 2004 is Leroy Merlin, another very strong retailer that has chosen to expand into neighbouring markets through acquisition.

8. It is, in fact, remarkable how few of the western European DIY retailers have tried to expand outside their home market. Those that have made a move to capitalise on growth opportunities in the South and East of Europe have made a huge impact. The Germans have quickly established a lead in eastern Europe, while Kingfisher has concentrated on western Europe and Leroy Merlin has made for the developing markets in southern Europe.

9. Looking to the future, another way Mintel suggests that the market can mature successfully is to develop its e-commerce offer. It is surprising, for example, how few retailers include the delivery of bulk goods in their online offer.

10. Sales by DIY retailers in the 19 countries* were some € 84.4 bn excluding VAT in 2004 and € 86.1 bn in 2005. Mintel forecasts that sales will grow by around 37 per cent by 2010.

For more information and a free table of contents please call Mette Holm on +44/207/ 606 60 00 or mholm@mintel.com. Mintel International Group offers a wide range of market intelligence reports. Visit mintel.com to learn more.

*Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Republic of Ireland, Italy, The Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the UK.

Menü

Menü