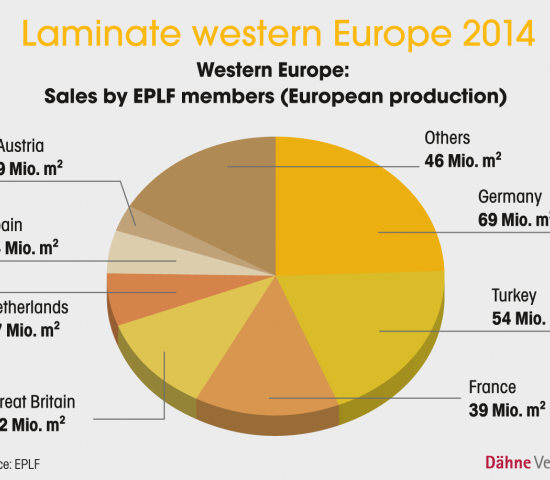

The core markets of western Europe (including Turkey) were down by nearly 3.5 per cent in all in 2014. In absolute figures, sales in western Europe fell from 290 mio m² in 2013 to 280 mio m² in 2014.

Sales in Germany, the biggest single market in central Europe, tended once more to be slightly weaker. Sales in 2014 came to around 69 mio m² (2013: 72 mio m²).

Although Turkey is still the second-biggest target market in Europe, the decline there was striking, with sales by EPLF members falling by around 18 per cent in 2014 to 54 mio m² (2013: 66 mio m²).

EPLF members recorded marked growth in eastern Europe, notwithstanding the political situation, with sales of 110 mio m² (2013: 103 mio m²). This equates to an increase of six per cent compared with the previous year. Sales in Russia reached 27 mio m² (2013: 24 mio m²), putting it on a par with Poland, which improved to 27 mio m² (25 mio m²).

Sales in North America increased in 2013 to roughly 28 mio m² and this trend continued in 2014 with sales of 30 mio m². In Asia- Pacific, overall sales by European manufacturers amounted to around 15 mio m² (2013: 13 mio m²), an increase of 15 per cent. The Chinese market in particular, including Hong Kong, showed significant growth.

The market in South America was stable on the whole at 17 mio m² (2013: 17 mio m²) in 2014. While sales in Mexico fared less satisfactorily and declined to around four mio m² (2013: five mio m²), the Chilean market delivered a much better result compared with the previous year at seven mio m² (2013: six mio m²).

Menü

Menü

Newsletter

Newsletter