Bathrooms are getting bigger and more luxurious in Germany, where “wellness” is becoming a growth area. The DIY retailers are also profiting from this trend

Wellness products are of growing significance in German DIY stores.

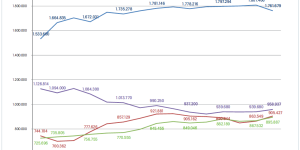

Seen overall, the bathroom occupies second place, behind the three-piece lounge suite and ahead of 13 other items, on the list of unfulfilled furnishing wishes. One of the ways in which this change of aspiration is expressed is the size of the bathroom, which has continued to grow over recent years: whereas just 22 per cent of bathrooms were over ten m2 in size in 1994, this figure was already 26 per cent in 2001.

At the same time the target groups are changing as well: people are living longer on average, the number of senior citizens is growing in proportion, and developing with it is the requirement for bathrooms tailored to their needs.

Bathroom segment in Germany by sales format

(.pdf-download)

The growth area of wellness

The market for wellness products (including saunas, steam showers and whirlpool baths) boasts a volume of e 305 mio at factory prices (retail volume: € 700 mio). Here Titze can see clear potential for growth, in contrast to the other ranges. For on 1 March 2003 the size of the German market for core ranges (bathroom furniture, mirror cabinets, baths and shower trays, shower enclosures, taps and fittings, as well as bathroom suites) amounted to just d 2.9 bn (retail volume: approx. € 6.3 bn), almost 20 per cent below the figure recorded three years previously. Where specialist ranges are concerned (bathmats, toilet seats and lids, lighting, sanitary accessories, mirrors and textiles), volume sales were down by more than five per cent to just under € 630 mio at factory prices (retail volume: € 1.35 bn). On the other hand, however, the Titze report sees the easy-access bathroom as a growth area corresponding to the demographic trend.

Further growth for DIY stores

The traditional distribution structures are breaking down still further, with the plumbing merchants losing three per cent of market share and the DIY stores growing by one per cent (in terms of factory prices). Forecasts predict that the plumbing merchants will lose their market leadership in the next five years. And at the same time, there is an ever-increasing number of trading companies that share out sales in the bathroom and plumbing sectors between them. Titze identified 10 235 businesses altogether. On the supplier side there are 987 firms, 54 per cent of which are foreign companies.

Size of German bathrooms 1994 and 2004

(.pdf-download)

Strong DIY stores

The DIY stores are meanwhile capable of competing with the plumbing merchants in certain specialist ranges. Recently DIY stores accounted for 48.9 per cent of the market volume of mirrors, and for as much as 54.2 per cent in the case of toilet lids. The plumbing merchants, however, are still ahead where all core product categories are concerned, even though the DIY stores now achieve a market share of 38 per cent in the case of shower enclosures, for example, and 33 per cent for taps and fittings. In the “wellness” field the DIY stores have a 32.9 per cent market share, whereas the plumbing merchants account for 52.9 per cent.

Looking to the future, managing director Winfried Titze expects an “increasingly divided market. Price competitiveness and luxury will be positioned more starkly side by side.” A clear-cut focusing on existing target groups will become increasingly difficult, since these will tend to change ever more rapidly.

To order: Titze Management Consultancy, E-mail: info@titze-online.de.

Menü

Menü