At the end of February, Obi became the second German DIY store operator to open its own online marketplace as part of the store on obi.de. Hornbach, the number three in the German industry ranking, has been active in this business segment since October. Bauhaus has announced its involvement as a marketplace operator, but has not yet gone live.

But what is so appealing about this business model that actually brings the competition into your home? Why do you do this as a DIY store operator? If you ask Michael Maihaus, who as Vice President Product Partnering at Obi is responsible for the new marketplace, this question, he first answers in principle: it is part of the strategy to offer customers an even broader and deeper product range that complements the current retail range and to work together with new partners to achieve this.

And it is part of the partner concept at Obi in general; he mentions the franchise partners, the suppliers who are seen as partners, the integration of stationary retail in the omnichannel concept and what is known at Obi as solution partnering, i.e. the planning and implementation of complete projects by external providers - partners. It is about “empowering the customer and providing them with the best offers with the best partners”, as has been frequently mentioned in the DIY sector for some time. At product level, there is now the Marketplace, which expands the range to include potentially more suitable products. From the customer's perspective: “There are so many different customer needs and tastes that - even though we already offer over 200,000 items in-store and online - we are nowhere near covering everything there is to offer in terms of relevant home and garden products.”

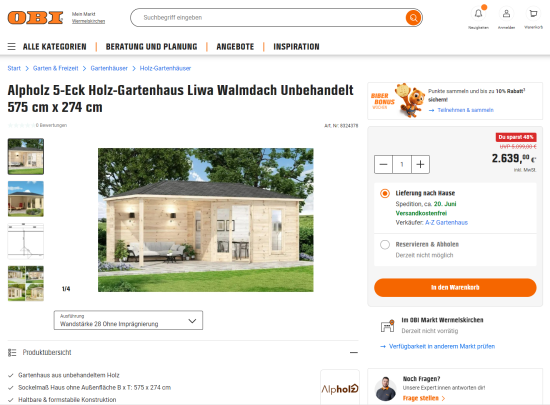

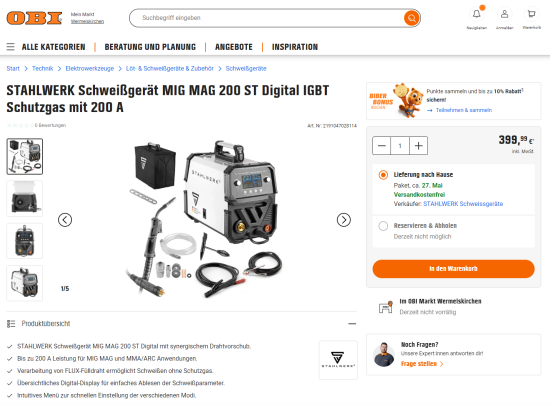

In this way, Obi wants to gain one of the advantages with which online retail has been trying to score points since its inception: the so-called long tail, i.e. the extension of the shelf with items that are not available in stationary stores, for example because they are too rarely in demand or too cumbersome in terms of logistics. Examples of this would be garden furniture, garden sheds or hot tubs, the demand for which is currently increasing enormously. On the one hand, the marketplace operator gains faster insights into trends and, on the other, can offer products more quickly without having to take any risks themselves.

However, the aim is expressly not to “list infinity”. That's why the magic formula at Obi is a curated range. This is the responsibility of a team of - clearly - partner managers who scrutinize the aspirants from the large circle of potential sellers. There are currently 40 external retailers with more than 25,000 items on obi.de, but the aim is to have “significantly, significantly more”, says Maihaus.

If Obi wants to compare itself with its European competitors, this is also necessary. The British Kingfisher Group, for example, the second largest DIY group in Europe, already has 400 external sellers on the diy.com platform, which opened less than two years ago, offering 340,000 products. Marketplace sales already account for a third of Kingfisher's e-commerce volume. The French group Adeo, European market leader and parent company of Leroy Merlin, already has around 640 sellers after one year, as diy has already reported.

The marketplace boss does not want to name a specific benchmark for Obi, for example in terms of gross merchandise value, i.e. the partners' external sales with Obi customers. However, he speaks of an ambitious business case with “significant relevance for Obi” and calls the marketplace one of the pillars of growth for the coming years. The benchmark here is the German market - where Obi recently achieved sales of around 4.2 billion euros - as the marketplace is currently only available on the German Obi website.

At the same time, Maihaus emphasizes that it is not just about the figures, but ultimately about increasing Obi's product range competence together with the new marketplace partners. The aim is to make the range even better for customers. On the other hand, like every marketplace operator, Obi is taking a certain risk that its brand perception could be damaged: A dissatisfied customer will blame Obi if they feel there is something wrong with the purchase or the product.

This is why Maihaus and his team of curators check, among other things, that the sellers fulfill a series of service level agreements after they have first introduced themselves at partner.obi.de with their basic information. The business must be conducted in Germany, i.e. a German VAT identification number must be available; it is specified how quickly the sellers must respond to customer inquiries; the products must be shipped from a European warehouse; and customer communication must be in German.

This applies to both pure retailers and manufacturers who are active on the marketplace with their products. Once their products are listed on the marketplace, they are initially only available for shipping to the customer; it is not (yet) possible to collect them from the store, for example via Click & Collect. However, customers can obtain advice in-store, online or via the “Hey Obi” platform.

Based on initial experience, Obi is convinced that enough sellers can be found to achieve the goal of further increasing expertise and competence under the Obi umbrella. “There are an extremely large number of highly professional retailers,” Maihaus reports from the partner acquisition process. “We realize: Wow, they know exactly what they want and are very clear about their product range.” For Obi, this is an important factor that needs to be exploited in order to offer customers the best product range: the expertise of the partners.

Menü

Menü

Newsletter

Newsletter